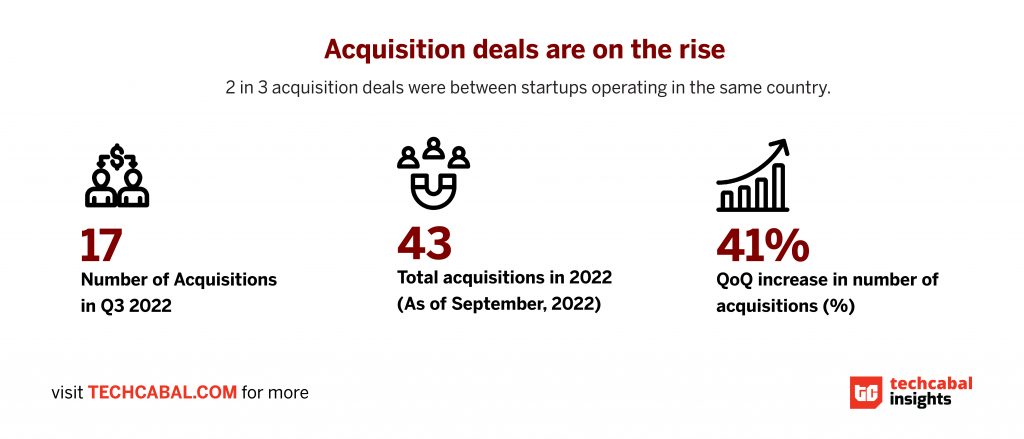

According to a new report from TechCabal Insights, Africa’s digital economy consultancy, acquisitions have become more common in Africa’s tech ecosystem, indicating a maturing market. According to the report, 32 acquisition deals will be completed on the continent in 2021. There were about 43 acquisition deals at the end of Q3 2022, indicating a consolidation trend.

Commenting on the findings of the report, Olanrewaju Odunowo, Head of TechCabal Insights, said “When it comes to Africa’s evolving tech ecosystem, appropriate context and nuances must be taken into account. Data without context is imbalanced and misleading and can lead to the wrong outcomes. Beyond crunching the numbers, we have gathered robust insights drawn from primary interviews with leading industry experts. Our aim with this report is to present easy-to-digest insights and data points that anyone – from founders to investors – will find valuable. ”

After two years of uninterrupted growth in VC investment, funding announcements have reached a halt. Startups have cut costs to extend their runway, and acquisition deals have become essential for survival, particularly among startups in the same market. Acquisitions between startups in the same market increased from 31% in Q2 2022 to 52% in Q3 2022.

According to TechCabal Insights’ State of Tech in Africa Report, the average seed ticket size remained stable at $2.5M in Q2 and $2.7M in Q3.

In recent years, a new narrative has emerged in Africa, embodied by the exponential growth of funding for technology startups. Investment in African startups increased 18x between 2015 and 2021, outpacing global rates by 2x between 2020 and 2021. Beyond the funding stories, however, there are the quieter tales of exits. By the end of H1 2022, African-focused private capital investors had made 22 full exits, a 29% increase over the 15 exits made in H1 2021.