Julia Schoonenberg, Senior VP for Financial Institutions (MEA), IDEMIA, discusses the pressing need for improved and environmentally-friendly measures to reduce the strain on our planet.

It is impossible to imagine our lives without plastics. This ultra-malleable and extremely cheap material is found in so many items supporting our daily lives —from the ubiquitous water bottle, to medical devices like digital thermometers, to the payment card. Unfortunately, the convenience of this material is the direct cause of the “throw-away” culture that has led to one of the most pressing environmental issues of today —plastic pollution. Single-use plastics account for an astounding 40 percent of the world’s plastic production. Despite widespread awareness on this issue, plastic production is expected to double by 2050, leading some experts to believe that there will soon be more plastic in our oceans than fish production.

The astronomical amount of plastics in oceans and landfills, coupled with terrible images of turtles chewing on plastic bags have pushed world leaders to promise to tackle the crisis. For example, Canadian Prime Minister Justin Trudeau has pledged to ban single-use plastics by 2021. In fact, the past five years have seen more than 60 nations take steps to reduce single-use plastics and 214 banks have pledged to reduce the negative impact caused by banking products and services. This is indeed very encouraging. As we know, Financial Institutions (FIs) are already strong supporters of environmental protection. I am sure they can play an even bigger role in mitigating the problem of single-use plastics.

For example, over six billion payment cards are produced globally every year, a majority of which are still produced from single-use plastic. The simple act of switching to ‘green’ payment cards offers FIs the opportunity to do even more for the environment.

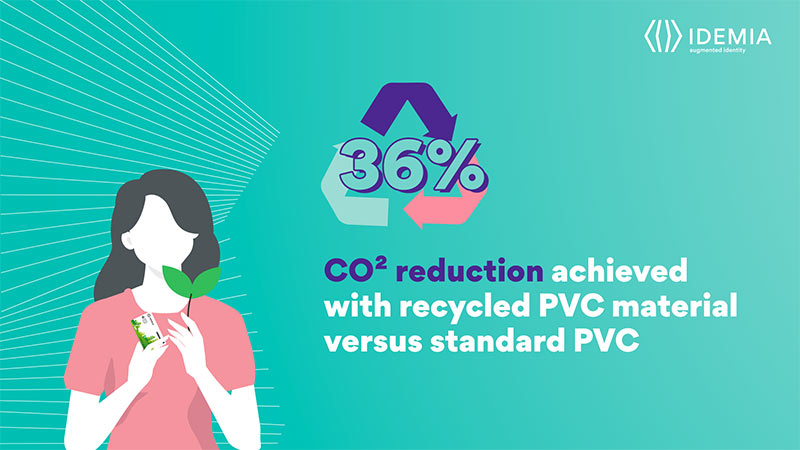

This line of thinking is not new. In 2018, Mastercard announced the Greener Payments Partnership. Working with card partners such as IDEMIA, the program worked to establish environmental best practices and reduce first-use PVC plastic in card manufacturing. And it is bearing fruit. Earlier this year, HSBC partnered with IDEMIA to leverage our GREENPAY eco-friendly offerings aiming to reduce CO2 emissions by 161 tons a year, and save 73 tons of plastic per year globally.

There is still so much more that can be done to deliver a sustainable and personalized card journey to the consumer. In addition to rPVC cards like GREENPAY card, there are solutions on the market today that enable a consumer to sign up for a bank card in a paperless and secure way. Some FIs and Fintechs are even trialing a more personalized card sign-up experience using the consumer’s own mobile phone. Innovations such as IDEMIA Connect enable the consumer to activate their new card by simply tapping it on their mobile phone.

From reducing the carbon footprint of the card to implementing eco-designed packaging, and replacing paper with digital services, everyone in the payment ecosystem has a part to play in ensuring that we deliver our consumers a payment tool with the lowest possible carbon footprint. There is only one planet Earth and we all have a responsibility to protect it.