How well is SaaS overcoming business impacts of the pandemic? First, there’s no negative impact on the revenues of big cloud infrastructure providers visible so far, according to a new research report out that we covered on TechCrunch this week. While some spending may have pulled back, growth from more remote work and other activities have maintained the overall momentum.

However, startups across the category could be “looking at around a 30% miss to plan in Q2,” Alex Wilhelm concludes based on a long interview with Mary D’Onofrio, a growth investor focused on the category at Bessemer Venture Partners. “This has tempered investor growth expectations. But even more than raw growth figures, SaaS investors are looking for efficient growth. In Bessemer’s eyes, a 1:1 ratio of ARR add to burn is the target. It won’t be easy. Startups selling to SMBs are going to hurt worse by rising churn than enterprise-focused startups, while startups selling to larger customers may struggle with new customer adds given travel restrictions. So, enterprise-focused startups will likely lean more on upsells than new logo adds. Those will also prove difficult, even if they won’t slow completely.”

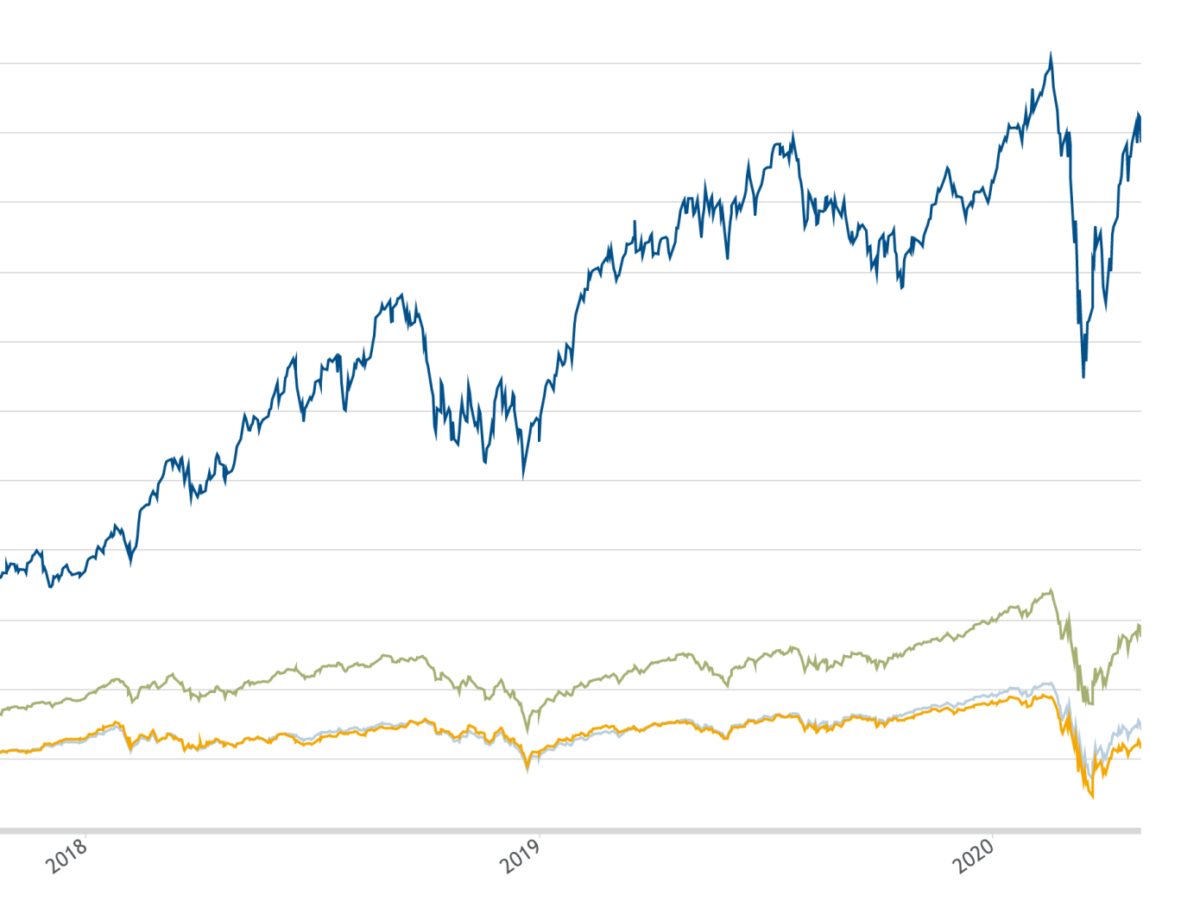

She and Bessemer had already developed a series of metrics to analyze the health of cloud companies, including a ‘Cash Conversion Score‘ and a Nasdaq emerging cloud index. Check out the rest of the article on Extra Crunch for how D’Onofrio sees those numbers being affected now.

This newsletter focuses on key meta topics for startups, and sometimes that means getting even more meta and talking about changes at TechCrunch. Josh Constine will be leaving us for the VC world, where he’ll be investing and heading up content with SignalFire.

If you have ever thought that Josh would be the one to really get your hot new consumer product idea first, you now have a new reason to talk to him. Read his thoughts on the new job in this personal post (and ongoing newsletter).

If you’re not familiar with the name, you’ve still read Josh quite a bit this decade if you’ve been reading TechCrunch — or tech news in general. He started here with me in late 2011 writing about Facebook and social trends, and has become one of the most influential writers on social and startup topics today. In addition to his traffic stats, top journalist rankings*, etc that one can measure most easily, we have watched his analysis regularly result in major changes to the main products of leading consumer internet companies in the world today.

His repertoire expanded over the years to include huge scoops (like Bing’s child-porn problem or Facebook’s secret VPN), memes (Zoombombing) and many appearances across global stages.

He has accomplished almost all of what great tech writers can accomplish and I cannot say I’m surprised that he wanted to try his hand at investing, having known him since before we first worked together last decade. I believe he’ll succeed as an investor, and be a force for good in that role like he has been here.

There is one thing I think he should still do as a professional writer, though — write a book. About his own life in the startup world this past decade. Trust me, you’d want to read it.