SISCO has revealed a net profit of SAR 54.8 million for H1 2021. Saudi Industrial Services Company, Saudi Arabia’s strategic investor in ports and terminals, logistics parks and services, and water solutions, has released its financial results for the six months ending June 30, 2021.

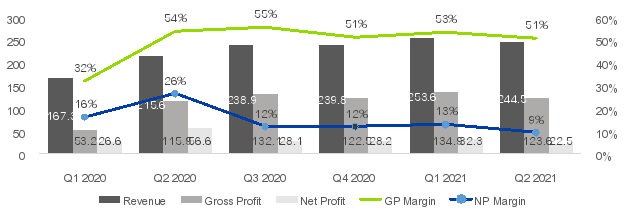

The first half revenue climbed by 30.1 percent year on year to SAR 498.1 million, while the second-quarter revenue increased by 13.4 percent to SAR 244.5 million, owing to good performance in the ports and logistics segments, as well as a minor increase in the water business. Substantial transshipment volumes in the ports segment and improved performance across the other divisions drove a 6.6 percent increase in gross profit to SAR 123.6 million in Q2 2020 from Q2 2020. Because of a drop in gateway volumes and an increase in direct expenditures, gross profit fell 8.4% from the previous quarter.

In the first half of this year, net income fell by 34.2 percent to SAR 54.8 million, compared to the same time the previous year, and by 60.3 percent in Q2 2021 to SAR 22.5 million, compared to the same quarter last year. This was primarily attributable to a SAR 31.9 million one-time IFRS 9 gain and a SAR 75 million release of asset replacement provision in the preceding year’s comparative periods. For the six months, adjusted EBITDA of SAR 279.1 million climbed by 62.6 percent year on year, resulting in an EBITDA margin of 56.1 percent. Total shareholders’ equity remained steady at SAR 1.17 billion in Q2 2021, with adjusted earnings per share (“EPS”) of SAR 0.28 compared to SAR 0.13 in Q2 2020.

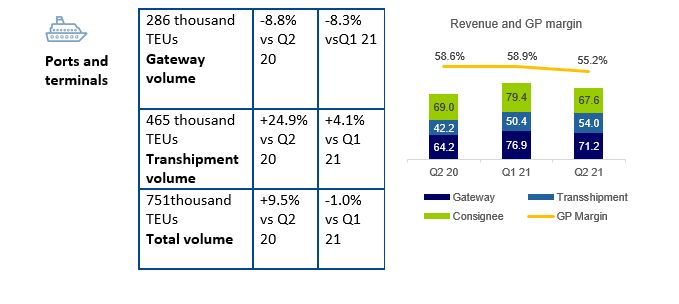

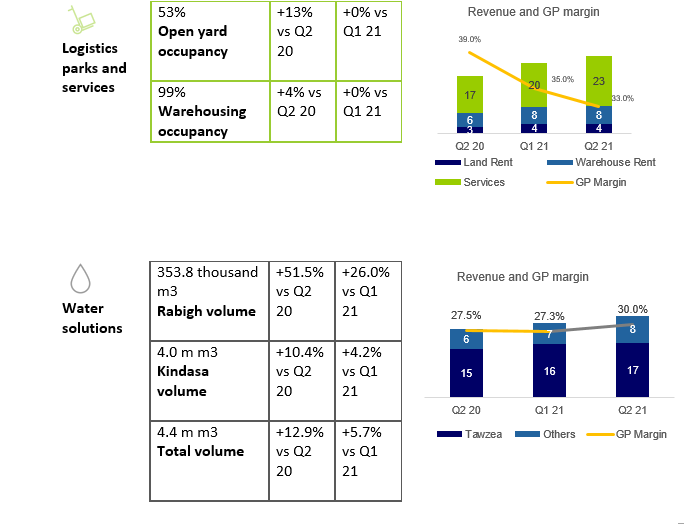

Revenue from the ports and terminals segment increased by 10.0 percent to SAR 192.8 million in Q2 2021, compared to SAR 192.8 million in Q2 2020, while revenue from the logistics segment increased by 37.9% to SAR 26.7 million. Volume growth aided the water solutions category, resulting in a 20 percent revenue gain to SAR 25.1 million in Q2 2021.

Mohammed Al-Mudarres, CEO at SISCO, said:

“SISCO delivered strong top and bottom-line results in the first half of the year with the port segment continuing to increase its market share in Jeddah Islamic Port for both gateway and transshipment volumes recording a 12% increase in total throughput year-on-year.

Despite the positive port segment growth, overall gateway volumes across the Kingdom came under pressure during the second quarter, which led to a decline in total gateway volumes during the quarter compared to the previous quarter and prior year.

The commendable performance by the port segment was supported by continued growth in warehouse and logistics services, with the water solutions business showing gradual improvement in trading performance.

Shortly after the end of the quarter, we completed the divestment of a 21.2% direct equity stake in our subsidiary Red Sea Gateway Terminal Limited (“RSGT”) to strategic partners PIF and COSCO. The financial impact of the transaction will be reflected in our Q3 2021 financial statements.

The review of the utilization of the proceeds from the divestment will be finalized shortly and we look forward to providing further details on this and our strategy during Q3 2021.”