Global payments provider Checkout.com has entered an agreement with Mamo, the fintech powering payments for SMEs across MENA, making Checkout.com the payments provider of choice for their flagship product Mamo Business. This deal further supports Mamo’s mission to accelerate the growth of SMEs in the MENA region’s flourishing digital economy.

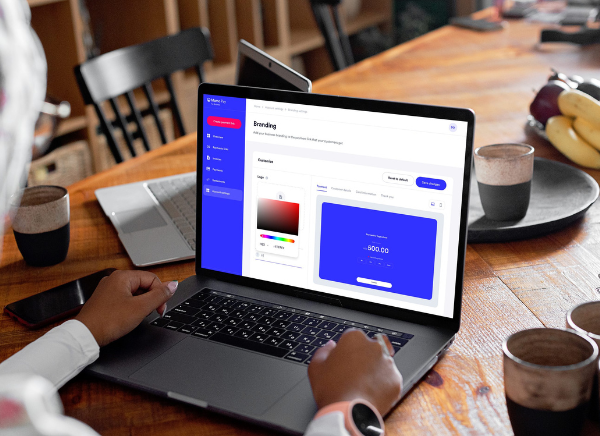

The announcement unlocks Checkout.com’s proprietary payments platform for Mamo’s SME customers, which offers a complete range of popular payment methods across the MENA region. With Checkout.com’s leading technology stack, Mamo Business customers will also experience market-leading payment performance, delivering the checkout experience consumers expect today. What’s more, supplemented by the direct integration with Checkout.com, Mamo will offer a swift onboarding process for its SME customers that can be done in just 24 hours. Mamo will offer a swift onboarding process for its SME customers that can be done in just 24 hours. Moving forward, SMEs using Mamo Business will have access to multiple payment channels including disbursements, invoicing, payment links, e-wallets, API integrations and exportable data reporting that helps them to maximize their revenue in every transaction. Additionally, SMEs can benefit from highly-reliable and secure transactions as Mamo is fully regulated and licensed by the Dubai Financial Services Authority (DFSA) to provide money services and is an officially registered Visa & Mastercard Payment Facilitator.

Furthermore, as part of this agreement Mamo Business customers will soon benefit from the unique Checkout.com Account Funding Transactions (AFT) feature. This is especially beneficial as card-to-card transfers in particular have an unmatched potential for taking business ecommerce performance to the next level.

“At Checkout.com, we are committed to providing high-quality payment processing services to our clients. The partnership with Mamo reinforces our commitment to this goal and to supporting the UAE government’s ambition to become a global digital economy leader, all while increasing the contribution of SMEs in this area. Our collaboration with Mamo ultimately guarantees small business owners a secure and swift payment processing capability, which enables them to start their ventures quickly and more successfully,” said Remo Giovanni Abbondandolo, General Manager for MENA at Checkout.com.

Imad Gharazeddine, CEO and Co-founder of Mamo, added: “Digital commerce in the UAE and wider GCC is evolving at pace, and the demand for fintech companies that can offer easy-to-deploy solutions to merchants is on the rise. We believe this strategic collaboration with Checkout.com is key to growing the ecosystem in line with UAE’s digital agenda and Dubai’s D33 economic agenda. We are excited to partner with Checkout.com as the market leader to bring these latest solutions to our customers in the UAE and eventually across the GCC.”

The agreement and collaboration comes at a time when the SME sector contributes significantly to the UAE’s GDP, with the SME sector representing more than 94% of the total number of companies operating in the country and providing jobs for more than 86% of the private sector’s workforce, according to the Ministry of Economy. Earlier this year, the Dubai Economic Agenda ‘D33’ further set ambitious goals of doubling the size of Dubai’s economy over the next decade with an annual AED 100 billion contribution from digital transformation.