1 April 2025, Tue |

9:34 AM

rivers cruising along an off-the-beaten-track might stumble upon an unusual sight in the coming months: a Rivian electric charging station.

The electric automaker has designed and is now starting to build out a network of electric vehicle charging stations throughout the United States as it prepares for the first deliveries of its R1T pickup truck and R1S sport utility vehicle. The network will include fast-chargers located along interstates, a strategy employed by Tesla and Electrify America, the entity set up by Volkswagen as part of its settlement with U.S. regulators over its diesel emissions cheating scandal.

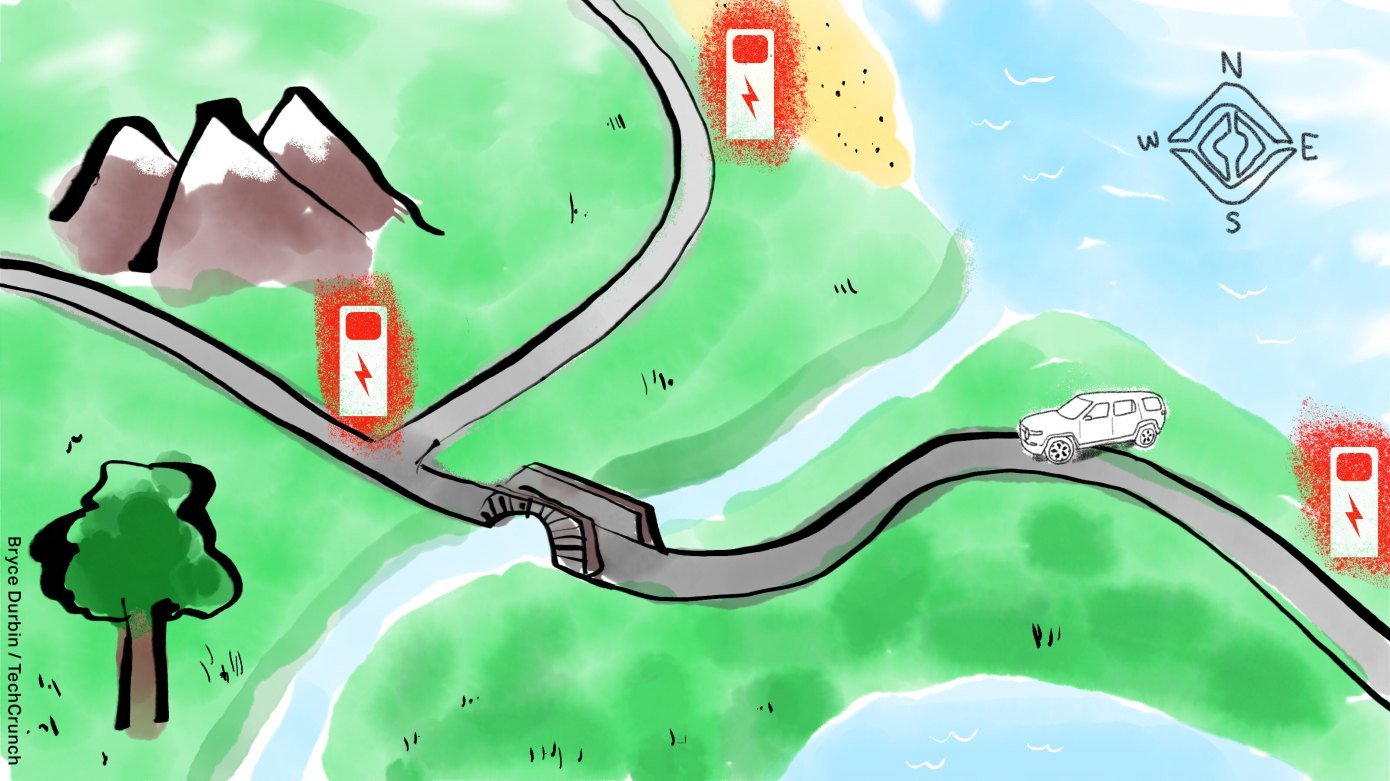

Rivian is adding a second layer to its electric vehicle charging game plan that’s atypical of the industry. The company will set up dozens of EV chargers designed to power up its electric vehicles while parked at adventurous destinations, from mountain bike and hiking trails to kayaking spots and maybe even near popular climbing crags. It’s a direct appeal to Rivian’s customer base and one required to build confidence in the brand and electric vehicles, in general, Rivian founder and CEO RJ Scaringe told TechCrunch in a wide-ranging interview about charging, batteries and automated driving.

“We’re excited about the opportunity to create Rivian charging locations that aren’t on the interstate, that help draw you or enable you to go to places that normally are not the kinds of places that invite or welcome electric vehicles because of charging infrastructure,” Scaringe said. “We’ve spent a lot of time thinking about how you can essentially create these curated drives where, depending on your point of interest, you can pick different paths. If you want to stop midway through the trip for a one-mile, two-mile or five-mile hike, you know, here’s a route that you want to take and here’s a charging location right next to it.”

The Rivian consumer-facing network is essentially two-tiers that will offer fast charging along the interstate where drivers need it, and strategically located destination chargers for when speed isn’t as important. It has created what Scaringe described as a “really interesting and challenging real estate” problem as the company figures out where those points of interest are and the best spots to locate charging stations along a particular route.

Building the Rivian network has been more than a test of consumer brand awareness and real estate wits. The electric automaker, which has raised about $6 billion, developed the tech in-house, including the high-speed DC charger.

“We haven’t talked about this really, but that charger, the power electronics module — or the backbone of those chargers — is something that we’re going to be deploying at scale,” Scaringe said, adding that the high-speed DC charger will be capable of up to 140 miles in about 20 minutes.

This hardware, and accompanying charging software, will be most visible in the consumer-facing Rivian network. However, the platform and the hardware around it also will be used for a fleet-based product, said Scaringe.

“If you think of commercial vans, the charger and the dispenser may look a little different, but the guts of these power modules that are used to build up the charging capability are identically applied in these very different applications,” he said. “It’s one of the reasons we built all that core competency, so we can build both fleet-based B2B charging solutions and the consumer-facing adventure network for Rivian customers.

Rivian has spent years and hundreds of millions of dollars to bring the R1T and R1S to market. And while it has raised $6 billion to date, those funds could easily be spent on developing technology and scaling up manufacturing. Scaringe argues that the Rivian network is a necessary undertaking if the automaker hopes to build confidence by controlling the entire ownership experience.

There are numerous third-party charging companies in operation today, including ChargePoint, EVConnect, EVGo, Electrify America and Greenlots. Legacy automakers have created partnerships and even made strategic investments in these businesses ahead of their own electric vehicle rollouts. But Scaringe isn’t willing to rely completely on third-party networks.

“The challenge is we don’t control those networks, so the payments platforms, the uptime, the performance, the ability to reserve a charger — all those things that take the friction of charging away — we don’t truly control,” said Scaringe. “With the Rivian Adventure Network, we have 100% control of that; we get to know what vehicles are charging or how they’re charging, the rates. We can be really creative in terms of locations, so it can allow us to get to places that are very specific and unique to Rivian.”

The Rivian network is clearly being built for Rivian customers. However, it doesn’t mean this will necessarily be a closed proprietary system like Tesla’s Supercharger network.

The two common connectors used for rapid charging are Combined Charging System (CCS) or CHAdeMO. CCS, a direct current connector that Rivian uses, is an open international standard that in recent years has gained popularity in Europe and North America.

This means that Rivian trucks and SUVs can also use any third-party CCS charging station without having to use an adapter. It also means that theoretically other electric vehicles with the CCS standard could use the Rivian network, although software could block their use.

Scaringe wouldn’t say exactly how many charging stations would be open by this summer, when the first deliveries of the electric pickup and SUV are expected to begin. He noted that dozens of charging stations — each station having an average of six charging connectors — will be erected in the U.S. in 2021.

“As that network is built it will take some of the pressure off the need to have the very large battery packs,” Scaringe said.

Every Rivian R1T and R1S comes standard with a battery pack that has more than 300 miles of range. The company plans to make a pack with more than 400 miles of range available in the R1T beginning in January 2022. A longer range R1S with both five and seven-passenger seating will be announced following start of production, the company has previously said. Rivian is also planning to eventually offer a smaller 250-mile range pack for a lower-priced R1T and R1S.

Even without specific numbers, it’s clear that Scaringe’s aspirations and plans extend well beyond “dozens” of the Rivian stations.

“The scale of a network is not something that you can turn on overnight,” he said. It takes months of time to get full coverage of the U.S. and years of time to get dense coverage, which by 2023 or 2024, we will certainly have.”