Like countless other 2020 expectations, our plans to launch Salesforce’s first Trends in Financial Services report earlier this year in March were derailed by the global pandemic. Facing an entirely different economic landscape, we regrouped with financial services leaders and commissioned a new research effort to uncover how the industry is changing – and what it now takes to succeed.

This report is a peek into the evolving financial services landscape at two points in time: immediately preceding the pandemic and nearly a year later. The result is a unique analysis of differences between 2019 and 2020 industry attitudes as well as net-new questions uncovering COVID-19’s impact on the industry.

Salesforce surveyed nearly 2,800 leaders across wealth management, insurance and retail banking to discover how financial services institutions (FSIs) prioritize – or don’t prioritize – the customer experience, long-term focused FSI approaches to the customer experience gap, and the competitive advantage of autonomous finance across financial institutions.

The pandemic exposes gaps in technology and the customer experience

While 68 percent of customers say COVID-19 has elevated their expectations of companies’ digital capabilities, many financial services institutions (FSIs) fell short during the early stages of the pandemic.

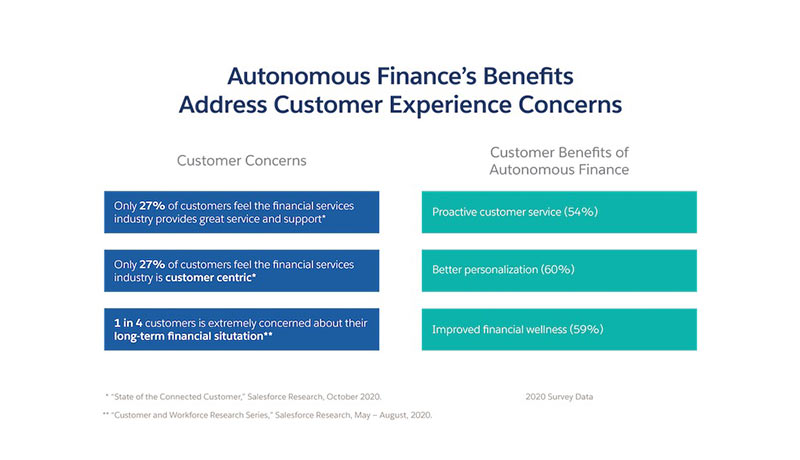

In the rush to handle the influx of new digital demands, FSIs prioritized implementing new technologies and improving customer trust – displacing customer experience (CX) as the top ranked priority. Customers have taken notice: only 27 percent feel the financial services industry is customer centric. Even fewer (23 percent) think the industry handled the pandemic well.

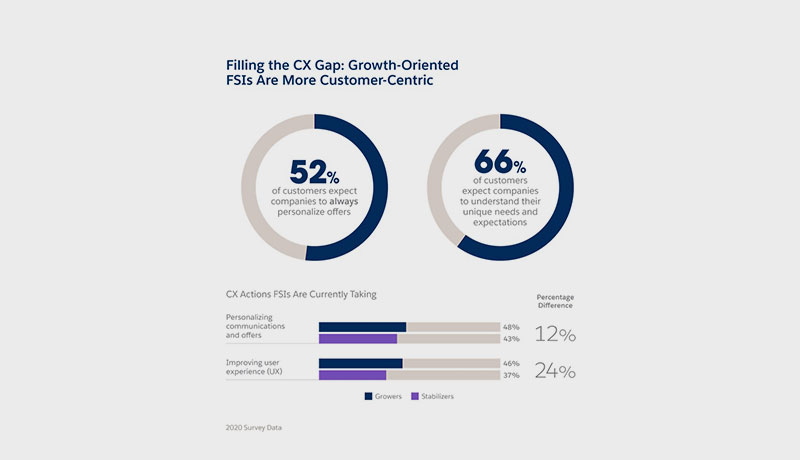

Today’s customers crave more than a transactional exchange: 80 percent of customers value the experience a company provides as much as its product and service offerings. Further, two-thirds of customers also expect companies to understand their unique needs and expectations. In today’s environment, companies who provide personalized experiences and deliver on desired outcomes are better positioned to succeed. We see this play out in the financial services industry as well.

Our study revealed that FSIs focused on long-term customer relationships over short-term wins are better poised for growth thanks to their focus on customer experiences:

Of course, improving customer experiences at scale can be challenging. However, technologies like artificial intelligence (AI) and automation can help bridge the gap between customer expectations and what FSIs can offer. Rachid Molinary, SVP of Digital Strategy & Innovation at Banco Popular, considers autonomous finance to be “the organic convergence of all the technology innovation we’ve been seeing over the years, from AI to unprecedented access to data.”

But what exactly does this look like? Forrester Research defines autonomous finance as algorithm-driven financial services that makes decisions or takes action on a customer’s behalf. For retail banks, this could mean automating account transfers based on past behavior. Insurers, on the other hand, could automate manual, resource-intensive claims processes.

The reported customer benefits of autonomous finance directly address experience shortfalls exacerbated by the pandemic. Six in 10 FSIs consider better personalization a top benefit of implementing the new capability.

In addition to personalization, autonomous finance aims to cut through complexity to produce improved outcomes at scale. In times of economic uncertainty, solutions to simplify financial decisions – like automated micro-savings tools – could be a boon for consumers looking to passively increase their savings.

The top reported business benefits also relate directly back to the customer: autonomous finance’s top business benefit is tied between improving customer experience and providing businesses with a better understanding of their customers.

Consumers are demanding more from financial services providers, and there is a near consensus in the industry that autonomous finance is going to be a major differentiator. According to 89 percent of financial services leaders, the first financial services companies to deploy autonomous finance will gain significant competitive advantage.

While today’s top use cases focus on maximizing process efficiencies, the next generation has the potential to unlock entirely new value streams. According to a focus group of financial executives, autonomous finance usage will shift from operational improvements to net-new customer applications as usage matures.

In the future, insurance companies could introduce entirely new value propositions like modularizing policies or insuring new risk categories. Retail banks could automatically select and allocate funds for higher education savings accounts for new parents.