ServiceNow the digital workflow company making work, work better for people introduced new products for telecommunications and financial services and provided more details about its healthcare and life science industry strategy. The company will deliver industry‑specific workflows to help customers in these industries accelerate their digital transformation to make work flow, whenever, wherever. ServiceNow also announced that it has formed a strategic go to market partnership with KPMG to support healthcare providers as they digitize clinical and business workflows.

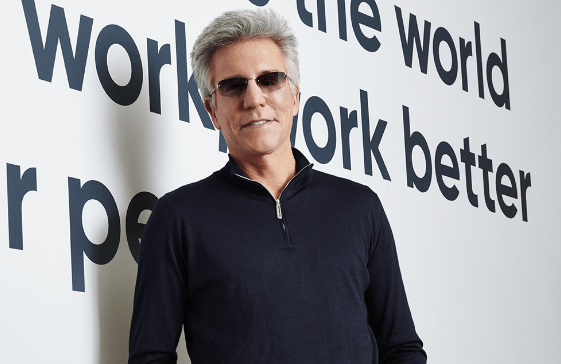

“We are bringing the Workflow Revolution to every industry to accelerate digital transformation,” said Bill McDermott, CEO of ServiceNow. “In the telecommunications industry, the Now Platform and 5G will intersect to fundamentally reinvent legacy experiences. We will give financial services leaders innovative new tools to strengthen customer loyalty as the economy begins to reopen at scale. Together with our partners, we have never been more inspired to help our customers meet all the challenges and opportunities of the 21st century economy.”

Communications service providers are in the midst of one of the largest opportunities in their history—the roll out of 5G. They are under pressure to exceed rising customer and employee expectations while managing costs, with little visibility across platforms, systems, tools, and fragmented data. ServiceNow’s new telecom products, Telecommunications Service Management and Telecommunications Network Performance Management, will provide new workflows that connect customer service and network operations, including Proactive Customer Care and Automated Service Assurance. The new products will be generally available later this year.

Most financial services institutions have made big investments in their front office but still struggle with manual, cumbersome processes in the middle and back office that undermine employee efficiency and customer experiences. ServiceNow Financial Services Operations is a newly introduced product with workflows that will transform operations for financial services institutions. These workflows will digitize customer requests like ordering a replacement card or inquiring about payments. The new product will give employees in operations a single system of action with insights across systems of record so they can manage processes end‑to‑end and collaborate in real‑time across departments. Financial Services Operations will be generally available later this year.

Investing in the Digitization of Healthcare

The global pandemic has exposed many shortcomings in existing healthcare workflows including staffing, patient care, and resource allocation. Organizations have turned to IT to fill the gaps. Building on its industry solution strategy, ServiceNow also announced a commitment to develop healthcare and life science products to help organizations in this industry transform their business and securely optimize and automate critical clinical and business workflows. Mike Luessi recently joined ServiceNow as general manager of Healthcare & Life Sciences to lead ServiceNow’s solutions strategy in this area.

Today, ServiceNow and KPMG are announcing a strategic go to market partnership for healthcare provider solutions, driving joint industry acceleration while ServiceNow develops its healthcare and life science solutions. This partnership pairs KPMG’s deep industry expertise with the power of the Now Platform to transform provider operations and patient outcomes.

New Product Highlights:

Telecommunications Products: ServiceNow’s new Telecommunications Service Management and Telecommunications Network Performance Management products will enable service providers to deliver better experiences to customers, contact center agents, and network operations teams so they can maximize their network technology investments while helping to reduce costs.

Built on the Now Platform, the products will extend ServiceNow’s capabilities in customer service and network operations with new telecommunications‑specific apps for Proactive Customer Care and Automated Service Assurance. The new products will enable service providers to better manage customer requests and quickly identify network issues for faster resolution. Service providers will be able to easily connect with their customers’ systems so they can deliver a superior experience at a significantly reduced cost.

Financial Services Product: Today, employees in operations at financial institutions spend too much time searching for data and answers scattered across multiple systems and departments. Employees often manage these workflows with spreadsheets and emails, which leave customers with slow turnaround times and limited visibility when they interact with their financial institution. The new Financial Services Operations product will transform operational processes and empower employees from front through back office to deliver differentiated customer experiences.

Purpose‑built for financial services, the new product will streamline common customer requests such as credit limit increases and payment inquiries, extending ServiceNow’s customer service capabilities with an initial focus on banking operations. With workflows connected end‑to‑end, financial institutions can maximize operational efficiency, significantly reduce operating and compliance costs, and increase customer loyalty.