Lenovo has revealed the Group’s financial results for the first quarter of 2021/22. The Group continues to boost its long-term and sustainable profitability by creating opportunities through speedy digitalising, smart conversion and IT upgrading in devices, infrastructures and applications throughout the globe.

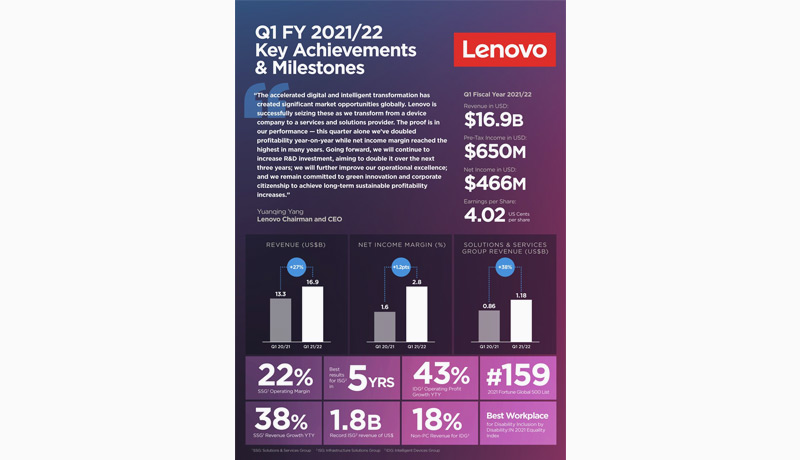

Lenovo’s performance benefited from these prospects, with pre-tax income nearly doubling to US$650 million (up 96%) and net income more than double (up 119%), with a net income margin of 2.8 percent, the best in many years.

Group revenue increased by 27% year over year to US$16.9 billion in the first quarter.

Looking ahead, the company expects more prospects for long-term growth and profitability in areas like vertical solutions, infrastructure solutions, premium PCs, and adjacent non-PC devices like tablets, smartphones, embedded computing, and other smart devices. Furthermore, innovation will continue to support lucrative and long-term growth. Lenovo will continue to invest in innovation and double its R&D investments over the next three years, after increasing R&D expenses by 40% year over year in the first quarter.

The company’s new business group structure of Solutions and Services Group (SSG), Infrastructure Solutions Group (ISG), and Intelligent Devices Group (IDG), which was announced earlier this year, is being reported for the first time this quarter.

| Q1 21/22 US$ millions | Q120/21 US$ millions | Change | |

| Group Revenue | 16,929 | 13,348 | 27% |

| Pre-tax income | 650 | 332 | 96% |

| Net Income(profit attributable to equity holders) | 466 | 213 | 119% |

| Basic earnings per share(US cents) | 4.02 | 1.80 | 2.22 |

“The accelerated digital and intelligent transformation has created significant market opportunities globally. Lenovo is successfully seizing these as we transform from a device company to a services and solutions provider. The proof is in our performance – this quarter alone we’ve doubled profitability year-on-year. At the same time, net income margin reached the highest in many years,” said Yuanqing Yang, Lenovo Chairman and CEO.

Also said, “Going forward, we will continue to increase R&D investment, aiming to double it over the next three years; we will further improve our operational excellence, and we remain committed to green innovation and corporate citizenship to achieve long-term sustainable profitability increases.”

“Similar to our global results, we have also mirrored our success story locally. According to IDC’s latest figures for the Gulf region, Lenovo has achieved the highest market share of traditional PC shipments, coming in at 26.3%. Our focus has remained on catering to diverse audiences with technology that speaks to their individual needs. For example, we launched our lightest ever ThinkPad – the ThinkPad X1 Nano, to empower today’s work from anywhere strategy. The passion for gaming in the Gulf region is something which captures worldwide attention – as a brand we have focused on upgrading our Legion lineup to help gamers better compete at a local and international level. For the upcoming months, we are focusing on further evolving our premium PC lineup, ensuring that we stay true to our vision of creating smarter technology for all,” said Mohammed Hilili, General Manager of Lenovo Gulf.

Customers’ increasing need for more complex IT services is altering the sector, opening up tremendous prospects for solution services and managed services, including the subscription-based as-a-Service model. The IT services sector is expected to be valued more than $1 trillion by 2025.

Q1 performance:

Looking ahead:

The corner stone for digital and intelligent transformation is ICT infrastructure, which is expected to be worth over US$250 billion by 2025. Lenovo is well positioned as a “full-stack” ICT supplier after investing in laying a solid foundation.

Q1 performance:

Looking ahead:

The epidemic has altered how people live and work, with PCs reclaiming their place at the hub of their digital life. The PC renewal cycle has shortened, the penetration rate has grown, and total PC demand will at least maintain current levels through 2025, with commercial demand swiftly returning. At the same time, the IoT market is predicted to grow at an 11 percent compound annual growth rate (CAGR) until 2025. And non-PC firms are exploding with new opportunities.

Q1 performance:

Looking ahead:

LENOVO GROUP

FINANCIAL SUMMARY

For the fiscal quarter ended June30, 2021

(in US$ millions, except per share data)

Q121/22 | Q120/21 | Y/Y CHG | ||

| Revenue | 16,929 | 13,348 | 27% | |

| Gross profit | 2,824 | 2,041 | 38% | |

| Gross profit margin | 16.7% | 15.3% | 1.4pts | |

| Operating expenses | (2,081) | (1,605) | 30% | |

| Expenses-to-revenue ratio | 12.3% | 12.0% | 0.3 pts | |

| Operating profit | 743 | 436 | 70% | |

| Other non-operating expenses – net | (93) | (104) | (11)% | |

| Pre-taxincome | 650 | 332 | 96% | |

| Taxation | (165) | (85) | 94% | |

| Profit for the period | 485 | 247 | 97% | |

| Non-controlling interests | (19) | (34) | (44)% | |

| Profit attributable to equity holders | 466 | 213 | 119% | |

| EPS (US cents) Basic Diluted | 4.02 3.53 | 1.80 1.76 | 2.22 1.77 |