By Nilanjan Dey

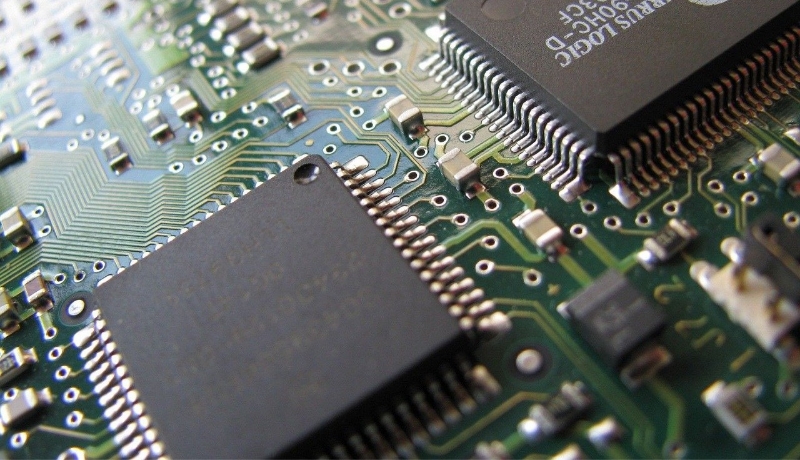

Chip sales growth is expected to slow down according to IT research firm Gartner. But why is it going down?

The report states that the fall is due to decreasing demand for smartphones and PCs caused by increasing energy and fuel costs and rising inflation affecting people’s disposable income. However, this demand was once at its peak during the pandemic leading to a shortfall of chips in the electronic industry. The report predicts worldwide semiconductor sales would grow 7.4% to $639.2 billion in 2022, down from its prior projection of 13.6% growth and compared to growth of 26.3% last year.

Companies like Samsung and Qualcomm have also given a similar forecast and have cautioned about the falling demand happening to macro reasons.

Apart from the reasons for rising inflation and high energy cost, Samsung also cited recession and adjustments from server clients that will be affecting the demand for chipsets. Qualcomm stated caution saying that the fall could worsen due to the war on Ukraine and lockdown in China concerning the supply chains.

Qualcomm expects to see a fall of 5% in its chip sales while Samsung touted a profit in chip sales in Korean won. According to Gartner, global semiconductor sales growth will slow down in 2022 and fall by 2.5% next year.

Taking a cue from this the U.S senate passed a bill helping its domestic semiconductor companies, the “Chips and Science” act helps the chip-making industry by giving government subsidies worth $52 billion and an investment tax credit of $24 billion.

To better compete with China in this sector, an extra $170 billion will be given to uplift scientific research as it looks to be the main aim of this bill. Many support the bill citing that China and the European Union provide ample stimulus to their native companies.